If his predecessor, Rigobert Roger Andély, favored international donors, the current Minister of Economy and Finance did not benefit from the same prejudices planned when he took up the position. Appointed in September 2022, one day after the legislative elections, the great Congolese financier nevertheless managed to prove his worth in less than a year, by successfully passing two successive IMF assessments.

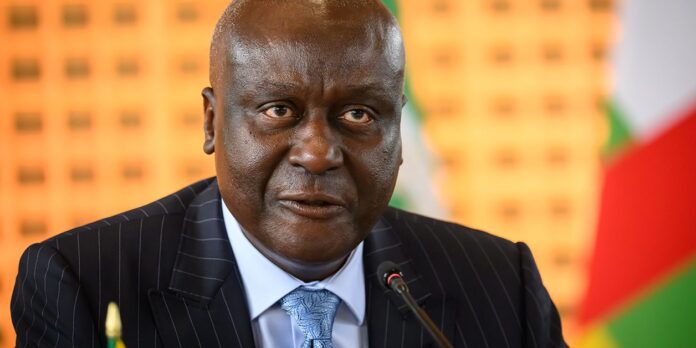

Graduated from the Berlin Higher School of Economics (in 1983), specialist in planning issues, Jean-Baptiste Ondaye, 65, spent his entire career in the Congolese administration. Director General of the Economy from 1997 to 1999, he was then head of the Planning and Development Directorate for ten years, before becoming Secretary General of the Presidency in 2009, with the position of minister, until his last appointment to the government. September. In 2016, Denis Sassou Nguesso also entrusted him with the presidency of the commission for monitoring and evaluating public policies and programs, as well as that of the ad hoc national commission to combat malnutrition.

Jeune Afrique: What were your ministry priorities last year?

Jean-Baptiste Ondaye: They are part of the priorities retained in the government's action program, in accordance with the social project presented by the President of the Republic. Our vision is, therefore, become the vector of economic and financial performance until 2026, respecting the improvement of the national development plan [PND 2022-2026] for modern governance of public finances in Congo.

This involves a number of priority actions, including strengthening economic diversification, growth and resilience to shocks, improving the digitalization of tax and customs revenue collection and dematerializing markets, public funds, as well as implementing forecasting and management tools for the State's cash flow and budgetary risks.

Growth expected to consolidate at 4% in 2023

What assessment do you make of the evolution of the economic and financial situation over the last twelve months?

Looking at the main macroeconomic indicators, it appears that the situation in Congo has improved in general, after years of recession due to the health crisis and after the war in Ukraine. The growth rate thus increased to 1.7% in 2022, when it was still -6.1% two years earlier. A result that can be explained by the good performance of the non-oil sector and the settlement of domestic debt arrears. According to the latest estimates, growth should consolidate at 4% in 2023, despite difficulties linked to the international context.

Public finances are also consolidating and the State is honoring its financial commitments, thanks in particular to better monitoring of cash flow. At the end of 2022, the execution of the State budget generated an overall balance of 837 billion CFA francs [près 1,276 milliard d'euros]compared to the deficit of 186 billion CFA francs recorded a year earlier.

Would you say that the country is moving away from over-indebtedness and finally entering a phase of development?

Debt reduction is one of the main challenges that we must face through our action program. This involves reconstituting our budgetary margins to allocate them as a priority to financing infrastructure expenditure and strengthening human capital, which bring growth and social progress.

The government has made considerable efforts to reduce debt. Externally, we have committed to exclusively using concessional loans, with a grant element of 35%, and general relationships with creditors have been normalized. Both with China and with others, debt renegotiations have been concluded and the installments are normally paid.

For its part, the domestic debt is subject to controls and verifications by auditing companies, and the ministry's services are in the process of developing a global settlement plan, with the assistance of the IMF and the World Bank. That flat it will then be consulted with the Council of Ministers for approval.

Relations with all of the country's creditors have been normalized and public debt is now sustainable

Finally, with Congo's replacement having been restored due to successful renegotiations and meeting deadlines, the government's objective is to maintain debt at a sustainable level. This does not exclude, if conditions permit, the expansion of financing sources to meet the enormous infrastructure needs allowed for the country's development.

In your opinion, does Congo once again inspire confidence in its financial partners?

Undoubtedly. Relations with all of the country's creditors have been normalized and public debt is now sustainable. The outlook of our central bank, like the IMF, shows generally developed economic prospects in the medium and long term.

The progress made by the country in terms of governance, transparency, business environment and combating corruption, with a view to improving public expenditure, were all pressured by our technical and financial partners. The detailed considerations of the IMF's third assessment clearly illustrate this renewed climate of confidence.

What are the consequences of inflation on the economy and the purchasing power of the Congolese?

Faced with the difficulties of this situation, obviously linked to the Ukrainian conflict, which is disrupting food supply chains, the government developed and implemented a resilience plan aimed at preserving the purchasing power of the Congolese. This plan, which amounts to 185 billion CFA francs, is structured around five strategic axes: the promotion of a replacement replacement policy; facilitate the transportation of basic products from production areas to consumer markets; stabilization of prices for essential food and agricultural products; support for local producers; and, finally, the rigorous application of administrative, fiscal and parafiscal measures.

This plan helped to contain, to a certain extent, a general increase in prices. The inflation rate in 2022 stands at 3%, compared to 2.1% in 2021 and is expected to reach 3.6% in 2023, exceeding the 3% standard established by Cemac.

Will Iran or Congo soon regain its own financing capabilities that will allow it to invest in its development?

This is the objective of the economic and financial program that we lead with the support of our partners, and the ambition clearly demonstrated in the PND 2022-2026. The economic recovery is being confirmed, public finances are consolidating and our debt is now viable. The priority now is to mobilize financial resources, both internal and external, to finance our PND and thus promote stronger, more sustainable and sustainable economic growth. more inclusive.